Alternative to a Pre-Established Company:

Incorporation Services

If you prefer not to purchase a pre-established company, we have an incorporation service to generate a new company for you, even if you are not located in the US, or are not a US Citizen and need a US company. We can establish a corporation for non-residents if you have your contact information, the name that you want to use for your company, who is going to be the director of the company along with a scan of that person’s passport and payment. (We highly recommend incorporating in the state of Wyoming.)

You do not have to be a US citizen to own or be a part owner of a C-Corporation or LLC.

We can have the company established in about a week. If you need a bank account in the US, you must come in person to the US so the bank can verify your ID. Additionally, you may be able to open a bank account in another country with the paperwork we send you. You would need to confirm with your bank what its current policy is.

Although we are not required by law to verify who you are, it is our company policy to get a copy of your passport, for our files.

(Please note, if your name appears on the OFAC list of blocked persons, companies, or countries, we could not provide assistance.)

We are a corporate courier that can incorporate, establish, and serve the assistive, administrative needs of your new company.

We can serve you in the following capacities. We can assist in incorporating a company in Wyoming or Nevada; and we can provide assistive, secretarial, and administrative backup. We believe these are the two most efficacious states in which to incorporate. (Information about incorporating in Delaware is included for your reference.)

We invite you to have us incorporate your new company in Wyoming, Nevada, or Delaware. Here is some comparative information for your consideration.

WYOMING INCORPORATION ADVANTAGE

- Annual Report filings and Certificates of Good Standing are available online

- Minimal initial filing fees

- Minimal annual fees

- No costly business license requirement

- Unlimited stock is allowed, of any par value

- Continuance procedure (allows Wyoming to adopt a corporation formed in another state)

- No state corporate income tax

- No tax on corporate shares

- No franchise tax

- One person corporation is allowed

- Stockholders are not revealed to the state

- Nominee shareholders are allowed

- No minimum capital requirements

- Meetings may be held anywhere

- Officers, directors, employees and agents are statutorily indemnified

- Doesn’t collect corporate income tax information to share with the IRS.

Re-Domicile Your Corporation or LLC to Wyoming Some benefits of re-domiciling to Wyoming:

- Allows you to move your out of state corporation or LLC to Wyoming

- The original incorporation date and EIN remain unchanged

- Your business gets all the benefits of any other Wyoming entity including:

- Minimal initial filing fees

- Minimal annual fees

- Unlimited shares

- Low regulation

- Information privacy

(Prices to re-domicile vary.)

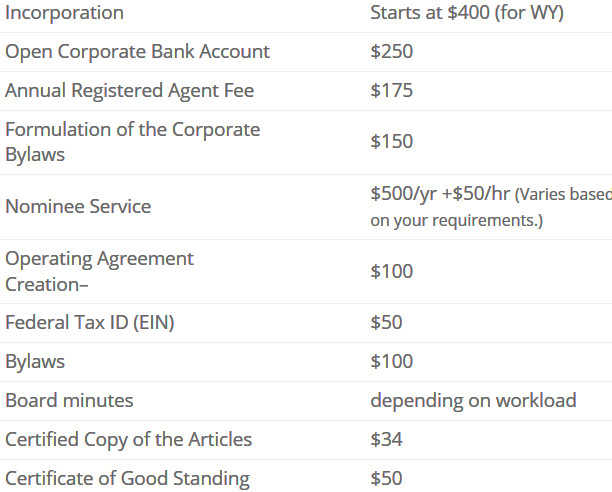

Here are costs associated with incorporation services in Wyoming. Prices can vary depending on your requirements which can influence the workload variables. We are generally more expensive for the incorporation service cost but our services go way beyond that and our most important service is our knowledge! Our experience ranges from the first step of incorporating to corporate administrative assistance to bookkeeping to going all the way to taking a company public.

.

Nevada Incorporation Advantages:

- Quick filing turnaround

- Expedited service available

- Articles of Incorporation and Organization are available online

- Initial, Annual, & Amended List filings & Certs of Good Standing are online

- Annual filings fees are unaffected by Nevada assets

- No state corporate income tax

- No tax on corporate shares

- No franchise tax

- One person corporation is allowed

- Stockholders are not revealed to the state

- Nominee shareholders are allowed

- No minimum capital requirements

- Meetings may be held anywhere

- Officers, directors, employees and agents are statutorily indemnified

- Doesn’t collect corporate income tax information to share with the IRS

. Miscellaneous Nevada Fees If Applicable:

Nevada Asset Protection: Nevada Asset Protection Trust Nevada has the most debtor-friendly legislation with its asset protection trust features:

Nevada Asset Protection: Nevada Asset Protection Trust Nevada has the most debtor-friendly legislation with its asset protection trust features:

- 6-month fraudulent transfer limit

- Bankruptcy protection

- Self-settled spendthrift trust

- No offshore trustees

- Assets may be located anywhere

- Can be originated from any state

Prices to form a Nevada Asset Protection Trust vary.

The fact that many large, public companies chose Delaware should demonstrate that large, public companies tend to benefit the most from incorporating in Delaware. Also, a major reason for incorporating in Delaware is because many institutional investors require Delaware. However, what about you? If attracting professional institutional capital is not a present or future concern, then this is not a relevant consideration for most entrepreneurs. Similarly, most newly formed corporation owners usually don’t care about how well-developed Delaware corporate law is. Thus, just starting out, Delaware is typically the exception for the corporation. Plus, should a corporation elsewhere grow and then decide that a Delaware corporation would be more favorable and applicable to its situation, it can re-incorporate in Delaware. (We can assist in this.) In the meanwhile, during the corporation’ formidable years, it can use the efficacy of Nevada or Wyoming (our recommendation).

Why Have Companies in the Past Chosen Delaware as their Corporate Home?

More than half a million business entities have their legal home in Delaware including more than 50% of all U.S. publicly-traded companies and 60% of the Fortune 500 businesses choose Delaware because Delaware provides a complete package of incorporation services, including modem and flexible corporate laws, highly-respected Court of Chancery, a business-friendly State Government, and the customer service oriented Staff of the Delaware Division of Corporations.

Traditional Advantages of Incorporating in Delaware:

- Flexible Laws – Delaware’s General Corporation Law is the most advanced and flexible business formation statute in the United States. It is designed to provide maximum flexibility in the structuring of business entities and the allocation of rights and duties among founders and shareholders.

- Delaware’s Court of Chancery uses judges instead of juries.

- Precedence = Less Litigation. Since judges are used, decisions are issued as written opinions that your startup company can rely on. Thus, most Delaware corporations do not end up litigating disputes because their professional advisers examine these published opinions and construct deals to avoid lawsuits.

- Privacy – Delaware does not require director or officer names to be listed in the formation documents.

Major Disadvantage of Delaware

Delaware is getting expensive! Here is what a lawyer with whom we are familiar says about Delaware:

When forming a new entity, I am often asked the best state of domicile. Following a July 1, 2014 increase in Delaware franchise taxes, I am also often asked the best state to re-domicile or move to following an exit from Delaware. Delaware remains the gold standard; however, there has been a definite shift and Delaware is now not the “only standard.” Part of the reason for the shift away from Delaware has been the increase in fees. Delaware calculates annual fees based on one of two methods: (i) the authorized share method; and (ii) the assume par value capital (asset value) method. For either method the annual fee is capped at $180,000.00. Even for small- and micro-cap business issuers, the annual fee often reaches the tens of thousands. For example, a company with 300,000,000 common shares authorized with a $.001 par value per share and 30,000,000 shares issued and outstanding and $20,000,000 in gross assets would pay $180,000.00 per year using the authorized share method and $70,350.00 per year using the assumed par value method. This is a very significant expense for a small company and, as you can see, the assumptions I have made reflect a very small business.”

Commercial Service Co. LLC

"When Instructions are Important,

We Deliver!"

© 2019 Corporate Courier