Alternative to a Pre-Established Company:

Incorporation Services

If you prefer not to purchase a pre-established company, we have an incorporation service to generate a new company for you, even if you are not located in the US, or are not a US Citizen and need a US company. We are a corporate courier that can incorporate, establish, and serve the assistive, administrative needs of your new company. We can serve you in the following capacities. We can assist in incorporating a company in Wyoming or Nevada; and we can provide assistive, secretarial, and administrative backup. We believe these are the two most efficacious states in which to incorporate. We can establish a corporation for non-residents if you have your contact information, the name that you want to use for your company, who is going to be the director of the company along with a scan of that person’s passport and payment. (We highly recommend incorporating in the state of Wyoming.) You do not have to be a US citizen to own or be a part owner of a C-Corporation or LLC. We can have the company established in about a week.

Company Formation – Our Services

Corporate Bank Account

If you need a corporate bank account in the US, you must come in person to the US so the bank can verify your ID. However, we will be initially listed as the officer/director at least until which time you shall travel to the bank to list yourself or whomever you may nominate as the person who shall be responsible for the financial affairs of the company. Additionally, you may be able to open a bank account in another country with the paperwork we send you. You would need to confirm with your bank what its current policy is. If you need us to further assist you with corporate affairs and duties, we will be pleased to assist. The cost to do this depends on your requirements, but the minimum fee to open a bank account is $250, and if you require us to remain on the bank account, the cost begins at $500 per year. Although we are not required by law to verify who you are, it is our company policy to get a copy of your passport, for our files. (Please note, if your name appears on the OFAC list of blocked persons, companies, or countries, we could not provide assistance.)

Registered Agent:

Both Nevada and Wyoming state laws require that their business entities maintain a Registered Agent. More information about what a Registered Agent is can be found by clicking here. Most people incorporate in the state in which you are doing business, however, there are compelling reasons to consider Wyoming, Nevada, or Delaware, and we invite you to have us incorporate your new company in one of the those states. Here is some comparative information for your consideration. (Information about incorporating in Delaware is included for your reference.)

Wyoming (1st Recommendation) (Click again to close)

WYOMING INCORPORATION ADVANTAGES:

Let us be your registered agent in Nevada or Wyoming. Call (855.608.4495) or email us Today!!

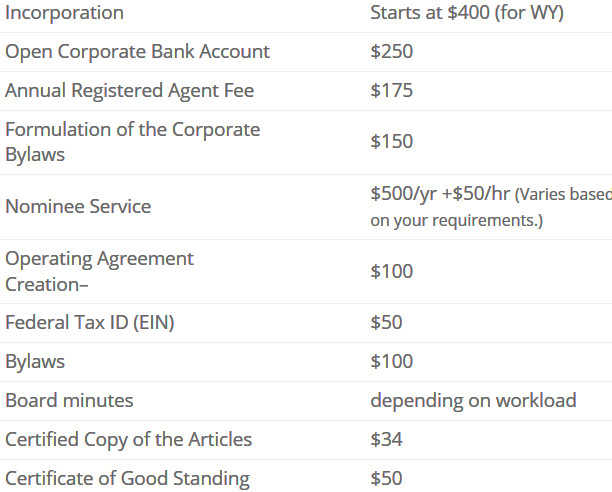

General Costs for Incorporation Services

(Prices to re-domicile vary.)

Here are costs associated with incorporation services in Wyoming. Prices can vary depending on your requirements which can influence the workload variables. We are generally more expensive for the incorporation service cost but our services go way beyond that and our most important service is our knowledge! Our experience ranges from the first step of incorporating to corporate administrative assistance to bookkeeping to going all the way to taking a company public. .

Nevada (2nd Recommendation)

Nevada Incorporation Advantages:

Miscellaneous Nevada Fees If Applicable:

Miscellaneous Nevada Fees If Applicable:  Nevada Asset Protection: Nevada Asset Protection Trust Nevada has the most debtor-friendly legislation with its asset protection trust features:

Nevada Asset Protection: Nevada Asset Protection Trust Nevada has the most debtor-friendly legislation with its asset protection trust features:

.

.

Delaware (Reference only)

Delaware Incorporation Advantages:

The fact that many large, public companies chose Delaware should demonstrate that large, public companies tend to benefit the most from incorporating in Delaware. Also, a major reason for incorporating in Delaware is because many institutional investors require Delaware. However, what about you? If attracting professional institutional capital is not a present or future concern, then this is not a relevant consideration for most entrepreneurs. Similarly, most newly formed corporation owners usually don’t care about how well-developed Delaware corporate law is. Thus, just starting out, Delaware is typically the exception for the corporation. Plus, should a corporation elsewhere grow and then decide that a Delaware corporation would be more favorable and applicable to its situation, it can re-incorporate in Delaware. (We can assist in this.) In the meanwhile, during the corporation’ formidable years, it can use the efficacy of Nevada or Wyoming (our recommendation).Why Have Companies in the Past Chosen Delaware as their Corporate Home? More than half a million business entities have their legal home in Delaware including more than 50% of all U.S. publicly-traded companies and 60% of the Fortune 500 businesses choose Delaware because Delaware provides a complete package of incorporation services, including modem and flexible corporate laws, highly-respected Court of Chancery, a business-friendly State Government, and the customer service oriented Staff of the Delaware Division of Corporations. Traditional Advantages of Incorporating in Delaware:

Major Disadvantage of Delaware:

Major Disadvantage of Delaware:

Major Disadvantage with Delaware:

Here is what a lawyer which whom we are familiar says about Delaware:

Here is what a lawyer which whom we are familiar says about Delaware:

|

Forming a Non-Profit – We Can Assist

Caveat: Please note that Non-Profits cannot distribute any profits to their members, contribute money to political campaigns, or engage in political lobbying. For advice, please obtain assistance from a lawyer that specializes in Non-Profits.

Click to Learn What's Involved in Forming a Non-Profit Organization

.

Forming a Non-Profit Organization

Forming a non-profit organization is a 3-step process:

|

Form a Corporate Entity The first necessary step is the formation of a corporate entity in one of the United States. Although this step closely resembles formation of a regular for-profit corporation, there are specific requirements that must be observed when forming a non-profit entity. State fees may also be different from those for for-profit corporations, usually lower. |

|

Apply for Federal Tax Exemptions The second step is application for tax-exempt status with the federal government. The most commonly-used federal tax exemption used for non-profit corporations is in Section 501(c)(3) of the Internal Revenue Code, which is why most non-profit organizations are referred to as “501(c)(3)” companies. The application is lengthy and complex; and as we are experienced in completing the Form 1023 and the many other forms and documents required for the completion, we can provide assistance in 501(c)(3) formation. |

|

Apply for State Tax Exemptions The final step is to obtain tax-exempt status in the State where the company is incorporated. Some states grant this status automatically, based on the non-profit formation documents and the 501(c)(3) status. In other states, a separate application is required. |

Formalities of Running a Non-Profit Even after a non-profit is formed, the company must observe many formalities and make timely filings with the IRS. Non-profit corporations are required to observe all of the same corporate formalities as their for-profit counterparts, including holding regular meetings of the board of directors and recording the minutes of these meetings. In addition, non-profit corporations are required to keep books and records detailing all activities, both financial and non-financial. Financial information, particularly information on the sources of support (contributions, grants, sponsorships, and other sources of revenue) is crucial to determining an organization’s private foundation status. Any non-profit qualified under Section 501(c)(3) exemption must file an annual information return: Form 990, Form 990-EZ, Form 990-PF or Form N-990. Each State also has it’s own filing requirements for non-profit corporations. We can assist in these preparations and can recommend a CPA for final review of these filings. Finally, all 501(c)(3) non-profits are required to have a Federal Tax ID (EIN) number, regardless of whether they have any employees. We can assist in preparing and filing your non-profit organization application should your requirements dictate.

Commercial Service Co. LLC

"When Instructions are Important,

We Deliver!"

© 2019 Corporate Courier